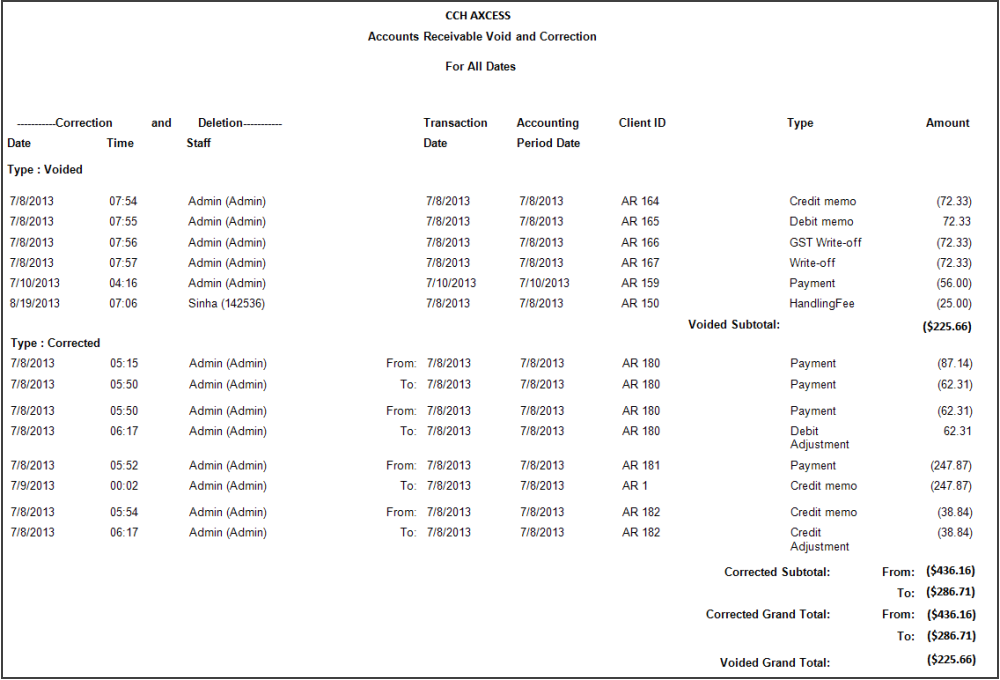

The Accounts Receivable Voids and Corrections report provides an audit trail of AR transactions that were voided or corrected.

Permissions Required for this Report

In the staff profile, staff must be assigned to a security group that is granted View functional rights for the following:

- Security group profile > Functional rights > Reports > Shared Library > Shared Views

- Security group profile > Functional rights > Reports > Firm Library > Custom

- Security group profile > Functional rights > Reports > Firm Library > Standard > Firm

- Security group profile > Functional rights > Reports > Firm Library > Standard > Practice

- Security group profile > Functional rights > Reports > Firm Library > <report name>

- Security group profile > Functional rights > Administration Manager > Client Manager > Approved Clients

Reports in Foundation that are Comparable

In Practice Management, the comparable reports are AR Void and Corrections Log. In Practice Advantage, there is no comparable report.

Report Specifications

The following report options and filters are available to determine the report contents.

| Options and Settings |

|---|

| There are no options and settings for this report. |

| Default Filters | ||

|---|---|---|

| Field Name | Operator | Value |

|

Transaction Date |

Between |

First Day Of Current Month, Today |

|

Type |

= |

All |

| Optional Filters | ||

|---|---|---|

| Available Fields | ||

|

Accounting Period Date |

Client Office |

Line of Business |

|

Amount |

Client Primary Service Type |

Manager |

|

Business Code |

Client Region |

Posted Date |

|

Client |

Client Sub ID |

Primary Partner |

|

Client - Principal |

Client Type |

Return Group |

|

Client Bill Manager |

Corr/Del Date |

Tax Type |

|

Client Business Unit |

Corr/Del Staff |

Transaction Date |

|

Client ID |

Corr/Del Time |

Type |

|

Client ID.Sub ID |

Corr/Del Type |

|

|

Client Name |

Financial Reporting Client Group |

|

| Grouping | ||

|---|---|---|

| Available Fields | ||

|

Business Code |

Client Name |

Financial Reporting Client Group |

|

Client |

Client Office |

Line of Business |

|

Client – Principal |

Client Primary Service Type |

Manager |

|

Client Bill Manager |

Client Region |

Primary Partner |

|

Client Business Unit |

Client Sub ID |

Return Group |

|

Client ID |

Client Type |

Sort Name |

|

Client ID.Sub ID |

Corr/Del Type |

Tax Type |

| Sorting | ||

|---|---|---|

| Available Fields | ||

|

Accounting Period Date |

Client ID |

Corr/Del Time |

|

Amount |

Corr/Del Date |

Transaction Date |

|

Applied To |

Corr/Del Staff |

Type |

Report Fields

The following fields are available for this report. The fields that display and the position of fields are based on the report's settings, grouping, sorting, and filters.

| Report Fields | |

|---|---|

| Field | Description |

|

Date |

The date the correction or void occurred. |

|

Time |

The time the correction or void occurred. |

|

Staff |

The name of the staff who corrected or voided the transaction. |

|

Transaction Date |

The original transaction date of the correction or void. |

|

Account Period Date |

The original accounting period date of the correction or void. |

|

Client ID |

The client ID and sub-ID (Client ID.Sub-ID). |

|

Type |

The type of transaction that is affected by the action. Type values can be Credit Adjustment, Credit Memo, Debit Adjustment, Debit Memo, Finance Charge, GST Write-off, Handling Fee, Miscellaneous Charge, Payment, or Write-off. |

|

Applied To |

The invoice number or the reference number of the AR transaction. |

|

Amount |

The original amount of the transaction that was corrected or voided. Invoices, finance charges, debit memos, debit adjustments, handling fees, voided payments, and voided credits are shown as positive numbers. Payments, credits, write-offs, voided debits, and voided finance charges are shown as negative numbers. |

Accounts Receivable Void and Correction Sample Report