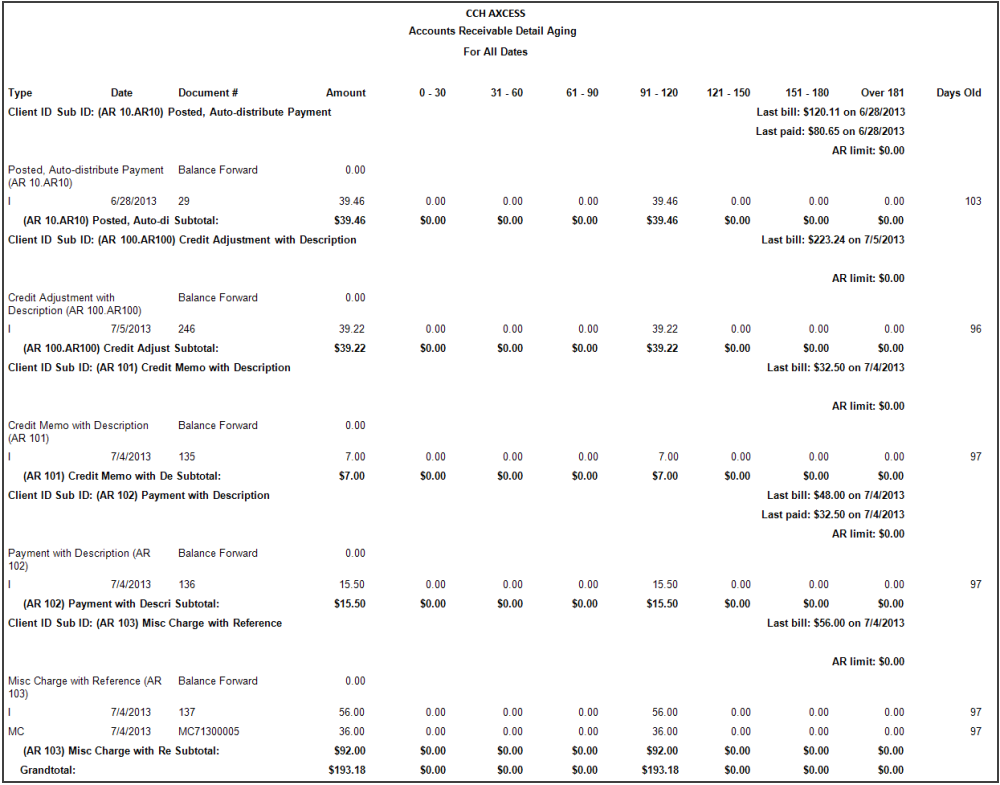

The Accounts Receivable Detail Aging report includes open (unpaid) or unapplied (credits/debits) accounts receivable. The report shows a balance forward from the starting date entered and detail of all unpaid/unapplied AR transactions after the balance forward to the ending date entered. Balance forward is calculated based on the date range entered and only includes nonhistoric AR. If a date range is not selected, balance forward is not used.

Permissions Required for this Report

In the staff profile, staff must be assigned to a security group that is granted View functional rights for the following:

- Security group profile > Functional rights > Reports > Shared Library > Shared Views

- Security group profile > Functional rights > Reports > Firm Library > Custom

- Security group profile > Functional rights > Reports > Firm Library > Standard > Firm

- Security group profile > Functional rights > Reports > Firm Library > Standard > Practice

- Security group profile > Functional rights > Reports > Firm Library > <report name>

- Security group profile > Functional rights > Administration Manager > Client Manager > Approved Clients

Reports in Foundation that are Comparable

In Practice Management, the comparable report is AR Open Item. In Practice Advantage, the comparable report is AR Ledger (Detail and Summary Aging).

Report Specifications

The following report options and filters are available to determine the report contents.

| Options and Settings | ||

|---|---|---|

| Option | Setting | Description |

|

Select To Age Transactions Using… |

List |

Determines the date to use to age the AR transactions. The options are Transaction Date and Accounting Period Date. |

|

Hide Details |

Yes/No |

Includes or excludes details of each transaction. If excluded, only the header for each group displays in the report with amounts only for the grand total. To view a summary amount for each group, select to subtotal the group. To view a summary amount by client, select to group by Client ID.Sub ID only with no subtotal. |

|

Include Clients With Transactions And AR Balance of $0.00 |

Yes/No |

Includes or excludes the transactions when the client has a 0.00 AR Balance and all transactions are distributed. The report does not include clients with a 0.00 AR balance unless they have AR activity. |

|

Include Credit Balances |

Yes/No |

Includes or excludes clients with an AR credit balance. |

|

Include Clients With a Minimum AR Balance Of… |

Amount |

Includes clients with the minimum AR balance that is entered for this option. |

|

Calculate Aging For Undistributed Payments Using… |

List |

Determines the date to use to calculate undistributed payments. The options are Undistributed transaction date and Oldest unpaid invoice date. |

|

Show Client AR Limit |

Yes/No |

Includes or excludes client AR limits. Note: To include this detail, you must include a grouping by Client Name, Client ID.Sub ID, or Sort Name. |

|

Show Client Last Payment Date And Amount |

Yes/No |

Includes or excludes the last payment date and amount received from clients. To include this detail, you must include a grouping by Client Name, Client ID.Sub ID, or Sort Name. Note: To include detail for this option, you must include a grouping by Client Name, Client ID.Sub ID, or Sort Name. |

|

Start Aging Period For Minimum AR Balance At… |

Number |

Determines the starting period for the balance to qualify for aging. |

|

Set Number of Days For Aging Period 1 |

Number |

Determines the number of days in aging period 1. A zero (0) amount excludes the period from the report. |

|

Set Number of Days For Aging Period 2 |

Number |

Determines the number of days in aging period 2. A zero (0) amount excludes the period from the report. |

|

Set Number of Days For Aging Period 3 |

Number |

Determines the number of days in aging period 3. A zero (0) amount excludes the period from the report. |

|

Set Number of Days For Aging Period 4 |

Number |

Determines the number of days in aging period 4. A zero (0) amount excludes the period from the report. |

|

Set Number of Days For Aging Period 5 |

Number |

Determines the number of days in aging period 5. A zero (0) amount excludes the period from the report. |

|

Set Number of Days For Aging Period 6 |

Number |

Determines the number of days in aging period 6. A zero (0) amount excludes the period from the report. |

|

Set Number of Days For Aging Period 7 |

Number |

Determines the number of days in aging period 7. A zero (0) amount excludes the period from the report. |

|

Hide Comma |

Yes/No |

Includes or excludes commas in numbers. |

|

Hide Penny |

Yes/No |

Includes or excludes pennies in amounts. |

|

Show Last Bill Date and Amount |

Yes/No |

Includes or excludes the date and amount of clients' last bill. To include this detail, you must include a grouping by Client Name, Client ID.Sub ID, or Sort Name. Note: To include detail for this option, you must include a grouping by Client Name, Client ID.Sub ID, or Sort Name. |

|

Show Separate Finance Charge Totals |

Yes/No |

Includes or excludes the finance charge total line. |

| Default Filters | ||

|---|---|---|

| Field Name | Operator | Value |

| Transaction Date | Between | First Day of Current Month, Today |

| Optional Filters | ||

|---|---|---|

| Available Fields | ||

|

Accounting Period Date |

Client ID.Sub ID |

Financial Reporting Client Group |

|

Client – Principal |

Client Name |

Manager |

|

Client Bill Manager |

Client Office |

Posted Date |

|

Client Billing Group |

Client Region |

Primary Partner |

|

Client Business Unit |

Client Sub ID |

Transaction Date |

|

Client ID |

Client Type |

Type |

| Grouping | ||

|---|---|---|

| Available Fields | ||

|

Client – Principal |

Client Name |

Manager |

|

Client Bill Manager |

Client Office |

Primary Partner |

|

Client Billing Group |

Client Region |

Sort Name |

|

Client Business Unit |

Client Sub ID |

Type |

|

Client ID |

Client Type |

|

|

Client ID.Sub ID |

Financial Reporting Client Group |

|

| Sorting | ||

|---|---|---|

| Available Fields | ||

|

Amount |

Client Name |

Transaction Date |

|

Client ID.Sub ID |

Document # |

Type |

Report Fields

The following fields are available for this report. The fields that display and the position of fields are based on the report's settings, grouping, sorting, and filters.

| Report Fields | |

|---|---|

| Field | Description |

|

Client ID Sub ID |

The client ID and sub-ID (Client ID.Sub-ID). |

|

Client Name |

The client name. |

|

Balance Forward |

The total of all unpaid/unapplied AR that exists before the starting date of the report. |

|

Type |

The type of AR transaction. |

|

Date |

The date of the AR transaction. |

|

Document # |

The document number of the AR transition, such as the invoice number, finance charge number, or check number. |

|

Amount |

The amount of the transaction. |

| 1st Aging | The amount of the transaction that is aged as 1st aging (aging period 1 per user selections). |

|

2nd Aging |

The amount of the transaction that is aged as 2nd aging (aging period 2 per user selections). |

|

3rd Aging |

The amount of the transaction that is aged as 3rd aging (aging period 3 per user selections). |

|

4th Aging |

The amount of the transaction that is aged as 4th aging (aging period 4 per user selections). |

|

5th Aging |

The amount of the transaction that is aged as 5th aging (aging period 5 per user selections). |

|

6th Aging |

The amount of the transaction that is aged as 6th aging (aging period 6 per user selections). |

|

7th Aging |

The amount of the transaction that is aged as 7th aging (aging period 7 per user selections). |

|

Days Old |

The number of days the transaction is old, which is calculated to the ending date on the report. |

Accounts Receivable Detail Aging Sample Report